OK, let me just start this post off by dismissing any concerns that you may have about me thinking followers are the most important measure for your social. Put simply it isn’t. But whilst we all outwardly say your followers, likes friends etc aren’t important, there is that element of vanity that means we all pay attention.

How to gain social media followers

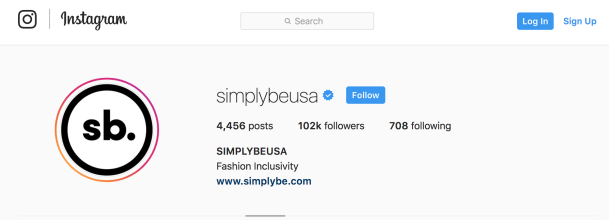

When looking at these numbers in context of a brand, there are genuine reasons why you need to consider follower numbers, but again, don’t make it your only focus. A good example of this was when I first joined N Brown Group. We had a focus on growing Social Media for Simply Be in the US to enable us to generate organic traffic, buzz and awareness. However the follower count on Instagram was very low (low double digit thousands). This prevented people taking us seriously in the social space and caused a restricted engagement level from our audience.

We set a target of 100k Instagram followers to enable us to look credible to the audience, which in turn would improve engagement and drive organic KPIs. Whilst I won’t go in to the specifics of what we did, the following tips on how to grow your social following will give some clues.

We hit our 100k Instagram target on SBE USA instagram

1. Be part of and lead conversations

The most important part of any social media approach is to be part of the conversations that your audience are interested and engaged in. Be relevant. The days of brands not following and not engaging with their community are over.

You need to know who your audience is. Don’t deviate from that to chase followers. Be credible and relevant to those people and they will share, which should gain you more followers

Obviously there are some hygiene factors that you also need to ensure are in place:

- Complete profile – make it interesting, provide as much info as concisely as possible and add links if relevant – this is your opportunity to convince the doubtful viewer

- Whilst ensuring your content is always relevant is the first rule, but don’t forget to use keywords you want to be known for, hashtags etc

- Make sure your feed is valuable and varied. Depending on the platform, sharing relevant posts is a good way to be part of the larger conversation but also allows you to tap in to other audiences.

2. Be active and engaged

Slightly linking to the previous point. People are often looking at how their numbers are perceived and from a very basic level, they do clean up the accounts that they follow. Make sure you aren’t one of the accounts they put on their consideration list to be unfollowed.

Test posting frequencies and test what content works well and when. Comment on other relevant accounts post. Communicate with your audience, seek out others and communicate with them.

For others to consider engaging with you, make sure you are present on your target platforms. Make your account worth following.

Now the counter to this is, don’t overdo it. You can become a pest, post too much and cause people to unfollow you as well. Testing is key.

3. Always Listen

Its important to always listen to your customers

Both points up to now have been more about your behaviour and what you post. But equally important is how you respond to your audience.

Now the obvious thing to mention here is genuinely listen to your followers, its surprising how many brands don’t read or respond to comments. You should also have a means to track sentiment to your brand and understand the feelings and perception to your brand that may not necessarily be directly posted to your platforms.

You can adapt your content strategy to help build on positive views or to address any negative perceptions.

A potentially less obvious point is look at how your followers are responding to the content you post. If they continually speak with their feet by not engaging, their could be something wrong with what you are producing. If they respond to a certain type, don’t just think you have the winning formula, but obviously look to see how you can expand on that theme. Don’t become a one trick pony though.

Remember, there is no shame in posting something and if it gets no engagement, take it down. Its not interesting to your audience so it doesn’t deserve a place on your feed. Even if it looks beautiful and you have spent time and money on the content, if your audience doesn’t like it, why is it there?

4. Build networks not just followings

Going right back to the start of this post, you shouldn’t just focus on the number of followers you have. You should be building a genuine network or community. Do this by seeking out relevant people in your network that you should be associated with. Sometimes this could simply be the accounts or people you follow. Don’t be tempted to just follow accounts with large follower base, follow relevant people, interesting people, people that you may want to share content from or engage with

Have a reason to be followed and reason why people would want to be part of your network. Could you post other accounts content on your platforms, share the audience reach and increase your follower base and that of the other account.

Its not just about influencers. Yes influencers are the new celebrities and depending on your sector, they can play an amazingly important role. But consider other brands, consider events, consider your customers. Bring those in that can enhance your network and get them active.

5. Have a point of view

Most importantly your platforms need to stand for something. It might be stunning creative. It might be a cheeky edge. It might even be deliberately controversial. Whatever your point of view you need to have one. Who wants to follow a vanilla account?

6. Hashtags

Use relevant hashtags

On some platforms (at the time of writing) hashtags are still useful. At this stage primarily Twitter and Instagram.

- Don’t overdo the hashtag use though as it can make posts look desperate or unprofessional

- Be careful on the hashtags you use. Research them before you post. Make sure the content is right to be seen next to your brand

- Make them relevant to the content. Its easy to jump on trending topics and you might gain some short-term followers, but why would you want them if they aren’t relevant and why would they hang around if the hashtag or content posted isn’t what you are about

7. Don’t forget the traditional

Now this is an obvious one. But most brands have other marketing channels that they use. Take the opportunity to include your focus social channels on all other channels. Don’t forget printed material. Don’t forget outdoor. Don’t forget TV. Your site and emails are key. But if you move goods around the country, use your vehicles, receipts, delivery notes etc

If you can round all of this up with one campaign theme that lends itself to social then you are on to a winner.

The campaign idea #WeAreUs that me and the team came up with when I was at boohoo was a classic example of this. It put social at the heart of everything we were doing and also created a movement that our customers and target customers wanted to be part of. It was such a success the #WeAre idea was adopted by many and is still in use. That in itself is a fantastic endorsement of what we did.

Summary

Remember, followers numbers should not be the be all and end all of your social objectives. Whilst it is often frowned upon, depending on where you are in your evolution, it is a valid KPI as long as its in conjunction with other KPIs, for example engagement.

Know why you want to increase followers and what you hope that will deliver. Have a target in mind and be as obsessed with that target as you would with others, but again not in isolation.

Above all, recognise it as a little bit of vanity and put it in context against your other objectives.

Finally, be aware of fake followers as they won’t last and don’t be tempted to buy followers. You really don’t want bots or accounts that just repost or follow paying platforms in your base.

Hopefully these tups are of interest and help. I would love to know the views of my readers so feel free to add in the comments or of course, tweet me on Twitter

Finally, don’t get obsessed with it all. Watch this video by DitchTheLabel to see what taking your social life too seriously can do

and Switzerland.

and Switzerland.  that many people completely ignore is

that many people completely ignore is